A Step-by-Step Guide to Paying Off Debt

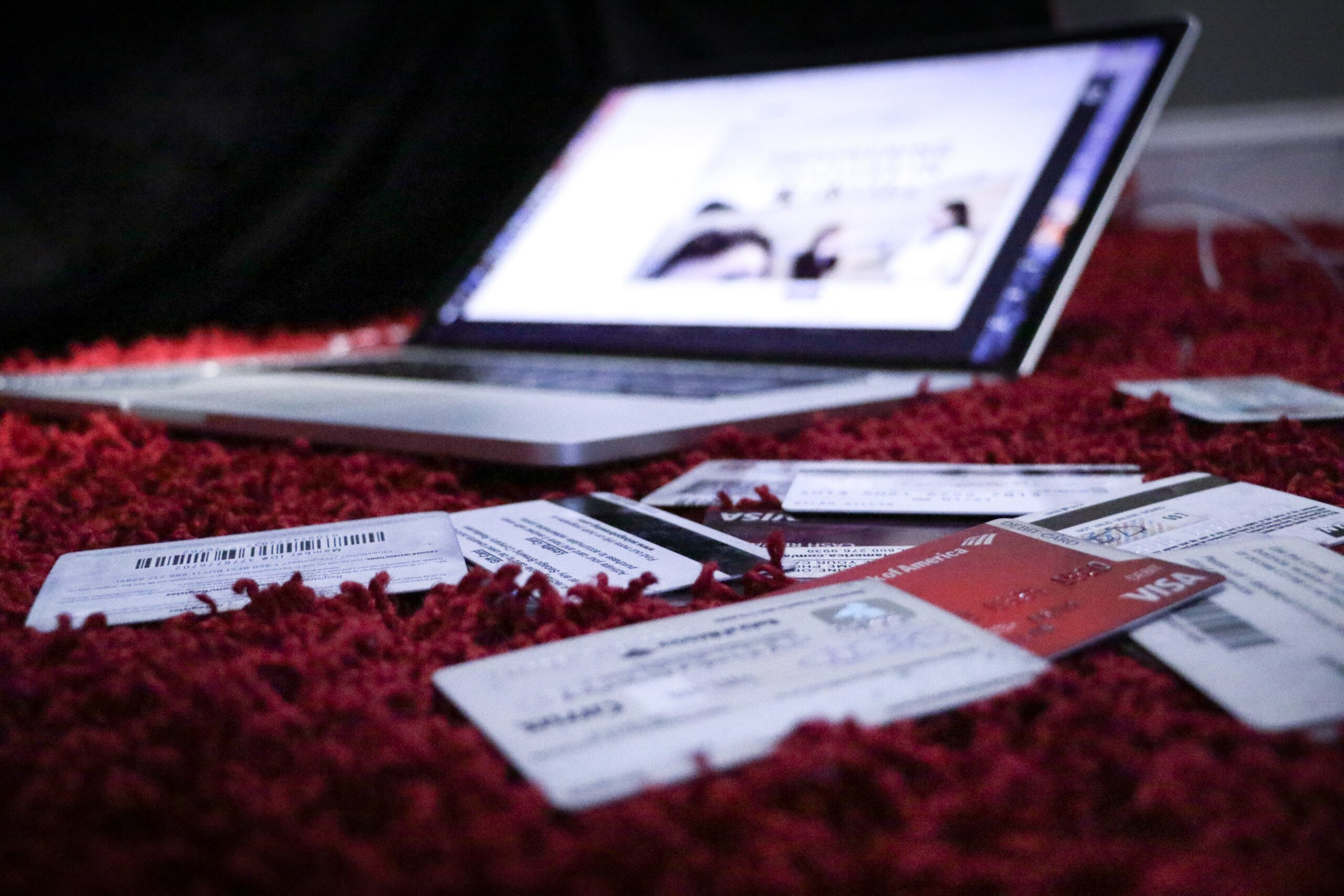

Debt can be a significant source of stress and financial burden for many people. Whether it’s credit card debt, student loans, or a mortgage, the feeling of owing money can be overwhelming. However, with a solid plan and commitment, it is possible to pay off debt and achieve financial freedom. Here is a step-by-step guide to help you pay off your debt.

1. Assess Your Debt: The first step in paying off debt is to assess the total amount you owe. Make a list of all your debts, including the balance, interest rate, and minimum payment. This will give you a clear picture of your debt and help you prioritize which debts to pay off first.

2. Create a Budget: Once you have a clear understanding of your debt, it’s time to create a budget. A budget will help you track your income and expenses, identify areas where you can cut back, and allocate funds towards paying off your debt. Be sure to include all your expenses, including bills, groceries, and discretionary spending.

3. Set a Debt Payoff Goal: Setting a debt payoff goal will help you stay motivated and focused on paying off your debt. Determine how much you can realistically afford to pay towards your debt each month and set a target date for when you want to be debt-free. This will give you a clear timeline and help you stay on track.

4. Prioritize Your Debts: Prioritizing your debts is essential to paying them off efficiently. Start by paying off high-interest debts first, such as credit card debt, as they accrue more interest over time. Make minimum payments on all your debts, but allocate extra funds towards the highest interest debt until it is paid off. Then move on to the next highest interest debt and repeat the process.

5. Consider Debt Consolidation: If you have multiple debts with high-interest rates, consider consolidating them into one loan with a lower interest rate. This can simplify your payments and save you money on interest over time. However, be sure to do your research and compare rates and fees before choosing a consolidation option.

6. Increase Your Income: Increasing your income can help you pay off your debt faster. Consider taking on a part-time job, selling unused items, or starting a side hustle to generate extra income. Allocate this additional income towards your debt payoff goal.

7. Stay Motivated: Paying off debt can be a long and challenging process, but staying motivated is key to achieving your goal. Celebrate small victories along the way, such as paying off a credit card or reaching a milestone in your debt payoff plan. Surround yourself with supportive friends and family who can encourage and motivate you.In conclusion, paying off debt requires a solid plan, commitment, and patience. By assessing your debt, creating a budget, setting a debt payoff goal, prioritizing your debts, considering debt consolidation, increasing your income, and staying motivated, you can achieve financial freedom and peace of mind. Remember, paying off debt is a journey, but the rewards are well worth the effort.